GJC on Gold’s Historic High: Chairman and Vice Chairman Weigh In

In times of economic and geopolitical flux, gold continues to assert itself as the most resilient and trusted asset class. The All India Gem and Jewellery Domestic Council (GJC) voices the pulse of the industry, especially at critical junctures such as this — when gold touches an all-time high once again. Below are the exclusive statements from GJC’s leadership on the current gold price surge.

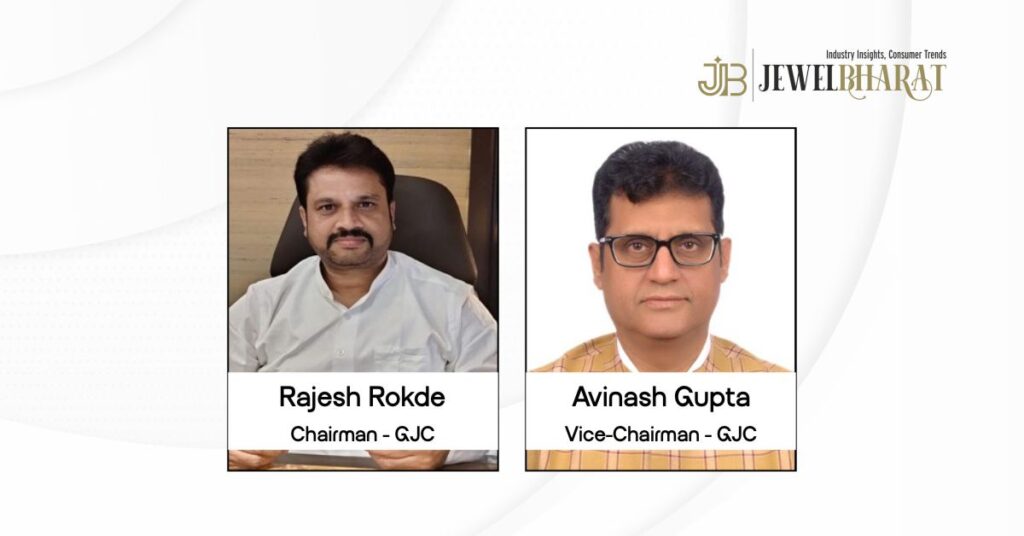

Rajesh Rokde – Chairman, All India Gem and Jewellery Domestic Council

“Geopolitical instability has continuously influenced gold prices for over five decades. With tensions rising, such as potential retaliation by Iran against Israel, the uncertainty keeps pushing gold rates higher. Even in the U.S., political challenges add to this volatility, making gold the preferred safe-haven investment across nations.”

He further adds, “Gold’s multi-purpose appeal—whether for adornment, investment, or security—keeps it in demand. Despite market corrections, consumers wait for stability before buying, though even a slight dip of ₹1,000 or ₹2,000 boosts their confidence. While wedding seasons drive traditional purchases, regular investments through SIPs and other occasions continue to support the market.”

Avinash Gupta – Vice Chairman, All India Gem and Jewellery Domestic Council

“Gold’s surge is a reflection of global economic uncertainty and geopolitical tensions. Investors worldwide continue to see gold as the ultimate safe-haven asset, driving demand even as prices cross historic thresholds. While corrections may occur, the long-term trajectory remains bullish, with gold proving its resilience time and again.”

He further explained, “The impact of geopolitical instability, currency fluctuations, and inflationary pressures continues to push gold prices higher. Consumers, despite waiting for corrections, recognize gold’s intrinsic value and its role in wealth preservation. Whether for investment, jewellery, or financial security, gold remains a trusted asset across generations. As we move forward, market trends indicate that demand will remain strong, with prices expected to reflect global economic shifts.”